The Future of Finance: Understanding Crypto, Custodial Services, L-P, and Swapping

The world of finance is undergoing a significant transformation with the rise of cryptocurrencies. Cryptocurrencies such as Bitcoin, Ethereum, and others have disrupted traditional financial systems, offering new ways for people to store value, pay bills, and conduct transactions. One key aspect of this shift is the growing demand for custodial services, liquidity provision (LP), and swapping platforms.

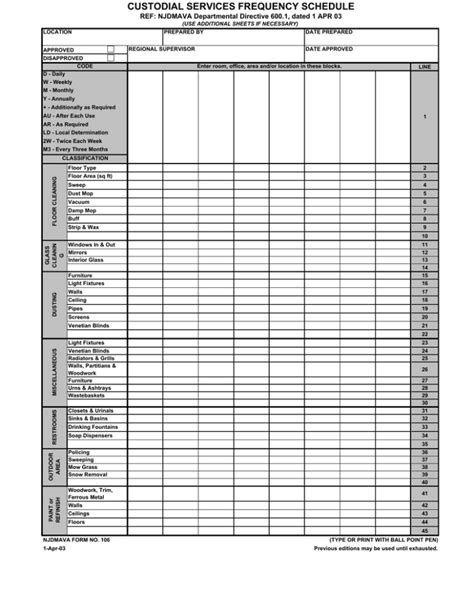

Custodial Services: Secure Storage and Management

Custodial services are a crucial component of the cryptocurrency ecosystem. These services allow users to securely store their cryptocurrencies on a network of computers called nodes. Each node verifies transactions and maintains a public ledger of all cryptocurrency transactions. Custodians also manage the physical storage of cryptocurrencies, ensuring that they are stored in secure locations.

There are several types of custodial services:

- Decentralized custody: This type of service uses distributed ledgers (blockchain) to verify transactions and store cryptocurrencies.

- Centralized custody: This type of service uses traditional financial institutions to store and manage cryptocurrencies.

Custodial services offer a range of benefits, including:

- Security: Custodians are responsible for securing the storage of cryptocurrencies, reducing the risk of theft or loss.

- Transparency: Custodians provide detailed records of all transactions, allowing users to track their assets.

- Cost-effectiveness: Custodial services can be more cost-effective than traditional financial institutions.

Liquidity Provision (LP): The Market for Unconventional Assets

Liquidity provision refers to the process of providing access to a pool of cryptocurrencies with low liquidity. This market provides a platform for investors to buy and sell cryptocurrencies at competitive prices, ensuring that markets remain liquid.

There are several types of LP platforms:

- Exchange-traded funds (ETFs): These ETFs allow investors to gain exposure to a range of cryptocurrencies while providing diversification.

- Trading platforms: These platforms connect buyers and sellers, facilitating the trading of cryptocurrencies.

- Market makers

: These market makers provide liquidity by buying and selling cryptocurrencies at competitive prices.

Liquidity provision offers several benefits, including:

- Increased efficiency: LP platforms can automate trading processes, reducing transaction costs.

- Improved accessibility: LP platforms provide access to a range of cryptocurrencies without requiring extensive financial expertise.

- Enhanced market knowledge: LP platforms offer users real-time price data and market insights.

Swapping: A New Way of Investing in Cryptocurrencies

Swapping is a new way of investing in cryptocurrencies, allowing users to exchange one cryptocurrency for another. This process takes place on an exchange-traded fund (ETF) or other trading platform.

There are several types of swapping platforms:

- Swap chains: These platforms connect buyers and sellers through a decentralized network.

- Exchanges: These exchanges allow users to buy, sell, and trade cryptocurrencies directly with others.

- Market makers: These market makers provide liquidity by buying and selling cryptocurrencies at competitive prices.

Swapping offers several benefits, including:

- Increased accessibility

: Swap platforms make it easier for users to invest in cryptocurrencies without requiring extensive financial expertise.

- Improved efficiency: Swap platforms can automate trading processes, reducing transaction costs.

- Enhanced market knowledge: Swap platforms offer real-time price data and market insights.