“Farm Pumps and Continuation Patterns: A Guide For Technical Analysis in the Cryptocurrency Market”

The World of Cryptocurrency has always been known for its volatility and unpredictability. A strategy that merchants have been used to capitalize on this volatility is the “pump and overturned” technique, which implies artificially inflating the price of a cryptocurrency through exaggeration and speculation before selling it at a high price and then throwing it into a low price. However, there are other available strategies that can help merchants avoid falling prey to these tactics and make more informed decisions about the purchase and maintenance of cryptocurrencies.

Pump Strategy

The pump strategy is one of the most popular ways for cryptocurrency investors to win an advantage in the market. This strategy implies creating exaggeration around a particular cryptocurrency through the dissemination of false information, using social media platforms to promote or participate in other marketing tactics that aim to attract new investors.

A key element of the pump strategy is the use of technical analysis to identify possible purchase opportunities. When analyzing graphics and patterns in cryptocurrency exchanges, operators can identify trends and patterns that may indicate a potential purchase signal. For example, a recently increased in the price of Bitcoin (BTC) has led many merchants to believe that it can be due to a bomb.

Continuation Pattern

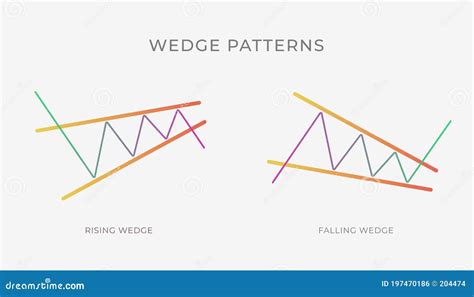

Another technical strategy that often uses cryptographic investors is the continuation pattern. This implies identifying a specific type of graphic pattern, such as a hammer or a fleeting star, and then using this pattern to predict future price movements.

The continuation pattern is a bullish indicator that suggests a strong purchase signal when the price of a cryptocurrency forms a hammer or a star shoots at the top of an upward trend. This pattern is particularly useful for cryptocurrencies that have been in a bull for some time, since it can provide a reliable indication of a potential correction.

Technical Assessment

Technical Assessment Refers to the process of analysis of the technical indicators and patterns of a cryptocurrency to determine its intrinsic value. When comparing the price of a cryptocurrency with its fundamental metrics, such as income, profit margins and market capitalization, merchants may have an idea of whether it is undervalued or overvalued.

A key indicator used in the technical assessment is the relative resistance index (RSI), which measures the speed of a cryptocurrency and the change in the price. A high rsi value may indicate that a cryptocurrency is oversized, while a low rsi value may indicate that it overloads.

Another key indicator used in the technical assessment is the strategy of divergence of the convergence of the mobile average (MACD), which implies the use of two mobile average to predict future price movements. By identifying divergences between the macd and other indicators, merchants can get an advantage to make purchas and sale decisions.

Conclusion

In Conclusion, the world of cryptocurrency is full of strategies that can be used to make informed decisions about the purchase and maintenance of cryptocurrencies. The pump strategy implies creating exaggeration around a particular cryptocurrency through false information and marketing tactics, while the continuation pattern is used to identify specify graphics patterns and predict future price movements. By using technical indicators such as RSI and MACD, merchants can get an advantage to make purchas and sale decisions.

Ultimately, the key to success in the Cryptocurrency Market is to stay informed about the latest trends and strategies, and be Willing to adapt to the Changing Conditions of the Market. Whether it is an experienced merchant or just starting, it is essential to stay disciplined and patient, since the cryptocurrency market can be volatile and unpredictable.