“Encrying Commerce Psychology: Invisible factors that promote market fluctuations and influence user behavior”

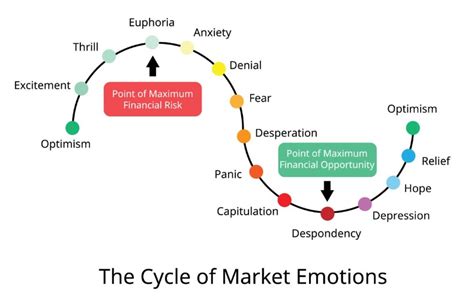

In the world of cryptocurrency trade, many users are eager to immerse themselves and start earning their own money, but few realize that psychology plays an important role in the way they make decisions about purchase and sale. Cryptocurrency markets are known for their volatility, which facilitates being trapped in impulsive emotions and decisions. However, understanding the psychological factors at stake can help merchants develop a more disciplined approach and increase their chances of success.

Authentication of 2 factors (2FA) vs. 3FA

When it comes to online security, two factors’ authentication (2FA) is a widely accepted practice that has existed for decades. 2FA adds an additional layer of protection to a user’s account, which requires not only a password but also a second form of verification, such as a fingerprint or a unique code sent by SMS or email. While 3FA offers even more security, it can be more cumbersome and may require the user to have two phones configured for each account.

In contrast, cryptocurrency exchanges generally offer 2FA, which is often more convenient than 3FA. However, some users may prefer 3FA due to their greater security. When choosing a encryption exchange, consider factors such as ease of use, rates and customer service.

Fiat currency: the sword with double edges

The concept of fiduciary currency has existed for centuries, where the currencies are issued by governments and linked to the value of a foreign currency or merchandise. The fiduciary currency is often considered a safe asset, since it can easily become other currencies, which makes it a popular value reserve.

However, the fiduciary currency also carries significant risks. The value of the fiduciary currency can fluctuate wildly, and when it does, investors can lose significant amounts of money quickly. In addition, the lack of inherent value in the fiduciary currency means that it is not supported by any product or physical active, which makes it vulnerable to inflation and the devaluation of the currency.

Cryptography Commerce Psychology: User behavior understanding

By exchanging cryptocurrencies, understanding user behavior is crucial to develop a successful strategy. Users tend to follow certain patterns and trends, which may be influenced by several psychological factors, such as:

* Confirmation bias : Users often seek information confirming their existing biases, while ignoring or minimizing contradictory evidence.

* Loss aversion : Users tend to fear losses more than they value potential gains, which leads them to react exaggerated when prices are volatile.

* Emotional decision making

: Users make impulsive decisions based on emotions, such as emotion or fear, instead of careful analysis.

To overcome these psychological challenges, merchants can use various strategies, such as:

* Diversification : The spread of investments in different classes and asset markets can help reduce risk and increase potential gains.

* Risk management : Establish clear levels of detention and the use of position size techniques can limit potential losses.

* Education : Continuous learning about commercial psychology and market analysis can improve decision -making skills.

In conclusion, understanding the psychological factors that influence cryptocurrency merchants is essential to develop a successful strategy. When recognizing the double -edged sword of the fiduciary currency, users must know the risks involved and take measures to mitigate them. Finally, when informed and educated, merchants can make more disciplined decisions and increase their chances of success in the world of commercial cryptocurrency psychology.